- What is sales tax

- eBay Sales Tax impacts e-commerce sellers

- Different Types of Sales Tax

- How to Calculate Your eBay Sales Tax

- How to Pay eBay Sales Tax

- How does sales tax work on eBay

- What is the eBay sales tax sellers must keep

- What Is the Marketplace Facilitator Law

- Where to Find eBay Sales Tax Details

- FAQs

- Conclusion

Are you planning to buy or sell items on eBay? Whether you’re selling vintage memorabilia, luxury goods, or everyday necessities, it’s important to understand the rules and regulations surrounding sales tax collection.

With changes occurring regularly across states and cities, familiarizing yourself with your local area’s unique requirements can seem overwhelming. We’ve gathered all of the information that you need to know about eBay sales tax in one place – so that you can be sure your business is operating ethically and legally!

What is sales tax

Sales tax is a consumption tax imposed by the government on the sale of goods and services. A conventional sales tax is levied at the point of sale, collected by the retailer, and passed on to the government. The amount of tax charged is usually calculated by applying a percentage rate to the gross price of the goods or services purchased.

The concept of sales tax has a long history, with evidence of similar taxes found in ancient Egyptian scrolls dating back to 2000 B.C. However, the modern version of sales tax as we know it began in the 1930s during the Great Depression. Governments were struggling financially, income tax revenues were plummeting, and there was a need for a reliable source of government revenue.

The first broad-based, general sales taxes in the United States were enacted by Kentucky and Mississippi in 1930. By 1940, 18 states, including New York and California, had implemented sales taxes. The use of sales tax increased and evolved over the years, adapting to the changing economic landscape, and has become an integral part of the fiscal system.

Many countries, including the U.S. Today, sales tax rates vary by state, and in some cases, cities, counties, and municipalities have their own additional sales taxes. Understanding these variations is crucial for eBay sellers to ensure compliance.

eBay Sales Tax impacts e-commerce sellers

As an e-commerce platform, eBay stands as an intersection where multiple tax jurisdictions can apply, making sales tax management a complex task for sellers. From the perspective of an eBay seller, you are required to collect sales tax from buyers residing in any state where you have a sales tax obligation, also known as “nexus.” A nexus is generally formed if you have a physical presence (like an office or warehouse) in that state, employ people there, or meet certain sales thresholds.

In recent years, the concept of nexus has expanded due to legislative changes, such as the South Dakota v. Wayfair, Inc. ruling in 2018. This ruling allowed states to mandate that out-of-state sellers collect and remit sales tax if they sell a certain amount or number of items into the state, regardless of physical presence. This is known as economic nexus. As a result, eBay sellers may be required to collect sales tax in more states than before. eBay provides a system to help sellers collect sales tax.

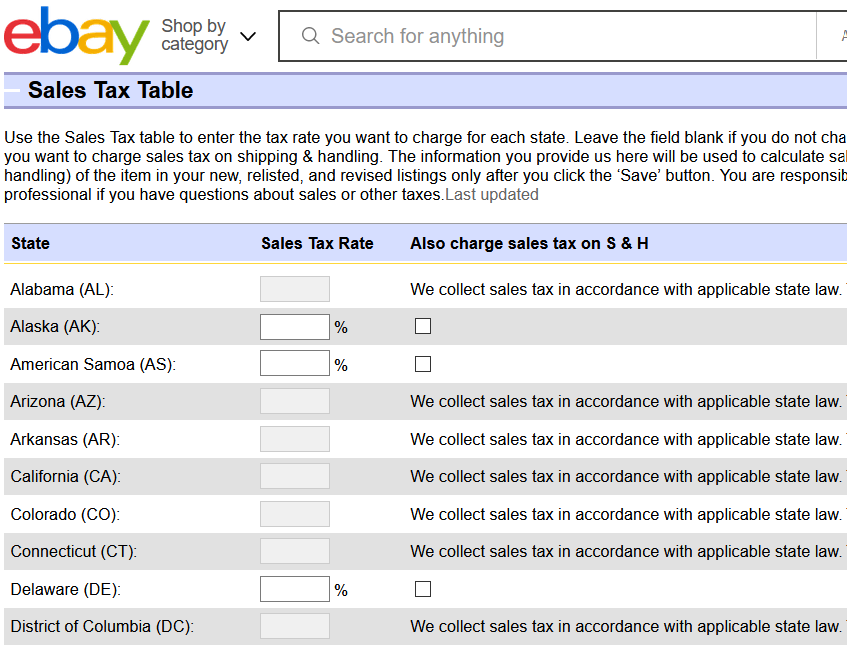

In the selling tools, sellers can set up tax tables specifying the percentage of sales tax to collect from buyers in each state. When a buyer purchases an item, if their delivery address is in a state where the seller is obligated to collect sales tax, it will automatically be calculated and added to the total at checkout.

However, it is essential for eBay sellers to regularly review and update their sales tax settings to remain in compliance as tax laws evolve. Moreover, many states have laws that require marketplaces, like eBay, to collect and remit sales tax on behalf of sellers for items shipped to buyers in their state. In these states, eBay will automatically calculate, collect, and remit the sales tax, and the sellers do not need to take any action.

However, sellers should always check the current list of these states on eBay’s website to stay updated. the few local jurisdictions in which eBay is not responsible for collecting sales tax, you’re required to figure out how much sales tax you need to collect and remit to local tax authorities.

Different Types of Sales Tax

When discussing the different types of sales tax, it is essential to understand their varied application across federal, state, and local levels.

Internet Sales Tax:

This is a tax on transactions conducted over the Internet. The South Dakota v. Wayfair Inc. case, decided in 2018 by the Supreme Court of the United States, paved the way for states to charge sales tax on purchases made from out-of-state sellers, even if the seller does not have a physical presence in the taxing state. This has significant implications for eBay sellers, who may now be required to collect and remit sales tax on online sales to customers in certain states.

eBay Income Tax:

Income earned from selling items on eBay may be subject to federal and state income taxes. The IRS will typically consider eBay sales to be a business if the seller intends to make a profit and regularly sells items on the platform. If you sell items on eBay as a hobby, you may still be required to report these earnings depending on their size and frequency.

Value Added Tax (VAT):

Some countries tax sales transactions through Value Added Tax (VAT) or Goods and Services Tax (GST). For eBay sellers doing business internationally, it’s important to understand the tax laws of the countries in which you sell. VAT and GST are typically calculated as a percentage of the selling price.

Tax on eBay Fees:

eBay charges sellers a fee for listing and selling items on its platform. These fees can be subject to tax in certain jurisdictions. Sellers should consider these taxes when calculating their costs of doing business on eBay.

Tax on eBay Sold and Bought Items:

Sales tax may be applied to the sale of items on eBay, depending on the location of the seller and the buyer. eBay has systems in place to automatically calculate, collect, and remit sales tax on behalf of sellers for items shipped to buyers in certain states. For the buyers, any applicable sales tax will be added to their total at checkout.

How to Calculate Your eBay Sales Tax

Calculating your eBay sales tax involves a few key steps. First, you need to understand the sales tax regulations in your specific state or any state you are shipping to. In the United States, sales tax varies by state, county, and city, so it’s crucial to be familiar with the sales tax rate that applies to the location where your item will be shipped.

Second, you need to determine if the product you’re selling is taxable. Not all goods are subject to sales tax, and again, this varies by state. For example, some states do not charge sales tax on clothing, while others do. Finally, you’ll need to apply the appropriate sales tax rate to the selling price of the item. This will give you the amount of sales tax that needs to be collected for that transaction.

Keep in mind that eBay will automatically calculate, collect, and remit sales tax on behalf of sellers for items shipped to buyers in certain states. This can greatly simplify the sales tax process for eBay sellers. To stay compliant with sales tax laws, it is recommended that you maintain accurate records of your eBay transactions, including the amount of sales tax collected and remitted.

This will help you prepare your tax reports and can provide valuable documentation in case of an audit. Remember, when it comes to taxation on eBay, it’s always a good idea to consult with a tax professional. They can help ensure that you’re following all relevant laws and regulations, which can help you avoid penalties and fines down the road.

How to Pay eBay Sales Tax

Paying your eBay sales tax is a straightforward process, but it requires diligence and precision. After determining the sales tax for the transaction, you’ll need to collect it from the buyer. If the transaction is in a state where eBay collects and pay sales tax on your behalf, you don’t need to do anything further. If not, you will need to remit the collected tax to the appropriate tax agency, which usually is the Department of Revenue of the state where the item was shipped.

Several tax tools can simplify this process. Tools like TaxJar, Avalara, and Quickbooks can automate sales tax calculations, reporting, and filings. They can track your sales across multiple platforms and break down the sales tax you owe by state and locality. They also integrate smoothly with eBay, making the entire process more manageable.

Remember, it’s crucial to make your sales tax payments on time. The frequency of these payments could be annual, quarterly, or monthly and depends on the specific rules of the state you’re remitting the tax. Late payments can result in penalties, so be sure to keep track of all deadlines and ensure that your payments are made promptly.

Again, as tax laws and regulations can be complex and subject to change, it is strongly recommended to seek advice from a tax professional. They can provide you with the most accurate and up-to-date information, assuring your compliance with all sales tax requirements.

Always keep in mind that handling eBay sales tax correctly is an essential part of running a successful and legitimate online business.

How does sales tax work on eBay

Sales tax on eBay operates on a marketplace facilitator model. As a marketplace facilitator, eBay is required to collect sales tax on orders shipped to customers in certain states, remitting it to the appropriate taxing authority. This model applies to sellers based in the U.S. and overseas, selling to buyers in the states where eBay is considered a marketplace facilitator.

eBay determines the tax rate based on the ship-to address and the items purchased. The tax is then added to the order during the checkout process and appears on the buyer’s invoice. eBay started collecting sales tax on behalf of sellers in certain states following the South Dakota vs. Wayfair, Inc. Supreme Court ruling in 2018.

This ruling empowered states to enforce sales tax obligations on remote sellers, including online marketplaces like eBay. The states in which eBay collects and remits sales tax are constantly updated in response to changing legislation. Sellers can find a current list on eBay’s website. However, if you are a seller in a state where eBay does not collect tax and remit sales tax, you are responsible for the collection and remittance.

This process involves setting up tax tables on eBay and providing accurate tax identification numbers. It’s also essential to understand the various sales tax rates and rules across different states. For example, while some states impose sales tax on shipping charges, others do not. Different states also have different tax rates and allowances for tax-exempt items.

What is the eBay sales tax sellers must keep

eBay’s sales tax policy is designed to ensure compliance with individual state regulations in the U.S. This obligation is derived from the Supreme Court’s ruling in South Dakota vs. Wayfair, Inc., which allows states to enforce sales tax laws on remote sellers. As a Marketplace Facilitator, eBay is responsible for collecting and remitting sales tax for orders shipped to customers in certain states, regardless of whether the seller is based within the U.S. or overseas.

EBay determines the sales tax rate based on the ship-to address and the items purchased. During the checkout process, the calculated tax is added to the order and is clearly reflected on the buyer’s invoice. The states where eBay actively collects and remits sales tax are subject to change due to evolving legislation, and an updated list can be found on eBay’s official website.

However, in order to purchase these goods without paying sales tax, you’re typically required to supply a valid reseller license or permit to the vendor. However, sellers based in states where eBay does not function as a Marketplace Facilitator are held accountable for the collection and remittance of sales tax. In such cases, sellers must set up tax tables on eBay, provide valid tax identification numbers, and stay informed about the unique tax rates and rules in different states.

For instance, some states impose sales taxes on shipping charges, while others do not. Moreover, tax rates and allowances for tax-exempt items vary across states. Therefore, sellers must keep abreast of these regulations to ensure they fulfill their tax obligations appropriately. Sellers should consult with their tax advisor about tax obligations for each state as the rules may vary on a state-by-state basis.

What Is the Marketplace Facilitator Law

The Marketplace Facilitator law is legislation introduced by several U.S. states that places the obligation for the calculation, collection, and remittance of sales tax on marketplace providers like eBay rather than on individual sellers. These laws were introduced in response to the growing e-commerce sector and are designed to simplify the tax process for small businesses selling online.

Under the Marketplace Facilitator law, when a purchase is made on a platform like eBay, the company is responsible for calculating the sales tax based on the ship-to address and the type of item being sold. The collected tax is then remitted directly to the state by eBay. By centralizing the process, the law mitigates the need for individual sellers to navigate the complex web of state sales tax laws, rules, and rates.

If the total amount exceeded $400 in profits, then even if you consider yourself a hobbyist, you would still need to report this income and possibly pay taxes on it However, it’s important to note that not all states have adopted the Marketplace Facilitator law. In states without this law, the responsibility for sales tax calculation, collection, and remittance falls back onto the sellers.

Therefore, sellers must stay informed about their obligations and set up tax tables on eBay if necessary. They also need to understand the tax rates and rules in different states, as there can be variances, including some states taxing shipping charges and others having exemptions for certain items.

Where to Find eBay Sales Tax Details

Sellers can find all the necessary details regarding eBay sales tax in the “Payment and taxes” section of their eBay account. This section provides a clear breakdown of the sales tax that has been collected and remitted on your behalf by eBay, if applicable. It also includes information about the sales for which you are responsible for collecting and remitting the tax if you’re selling in a state that has not adopted the Marketplace Facilitator Law.

In addition to this, eBay also provides a comprehensive documentation and resource center on its website where sellers can learn more about their tax obligations. These resources include FAQs on the Marketplace Facilitator Law, a list of states where eBay collects and remits sales tax, and guides on how to set up tax tables for states where the seller is responsible for tax collection and remittance. It’s a valuable resource that helps sellers navigate the often complex world of online sales tax.

Finally, for sellers who wish to dive deeper into tax obligations, it could be beneficial to consult a tax professional or a CPA for personalized advice. They can provide guidance based on your unique situation, helping to ensure that you remain compliant with all relevant tax laws and regulations. It’s important to remember that tax laws can change frequently, and staying informed is essential to being a successful online seller.

FAQs

Does eBay add sales tax to used items?

Yes, eBay does add sales tax to used items. Their automated system calculates and adds the appropriate sales tax at checkout based on the buyer’s delivery address and the sales tax rules of the respective state. This applies to all eligible items, whether new or used. It’s important to remember that eBay remits taxes collected directly to the applicable taxing authority, so sellers don’t need to take any additional action for these sales.

Does eBay automatically collect and remit sales tax?

Yes, eBay automatically collects and remits sales tax for transactions in states that have implemented the Marketplace Facilitator Law. Sellers are not required to take any action in these states.

Does eBay charge sales tax on purchases?

Yes, eBay does charge sales tax on purchases. The amount charged is based on the laws of the state where the buyer resides. As the marketplace facilitator, eBay calculates, collects, and remits the sales tax on behalf of sellers for orders shipped to customers in the applicable states. The sales tax amount is then added to the total cost at checkout.

What resources does eBay provide to help me understand my tax obligations?

eBay has a comprehensive documentation and resource center on its website. This includes FAQs on the Marketplace Facilitator Law, a list of states where eBay collects and remits sales tax, and guides on how to set up tax tables.

Where can I get personalized advice on my tax obligations?

If you want personalized advice on your tax obligations, it’s best to consult a tax professional or a CPA. They can provide guidance based on your unique situation to help ensure compliance with all relevant tax laws and regulations.

Conclusion

I hope this guide has provided you with a better understanding of eBay’s sales tax policies and how they may affect your business. It’s important to stay informed and up-to-date on these regulations to avoid any potential issues or penalties. Remember, eBay is here to support you and provide resources to help you navigate through the complexities of sales tax.